28+ fed increase mortgage rates

April 28 2022 at 1000 am. Get Instantly Matched With Your Ideal Mortgage Lender.

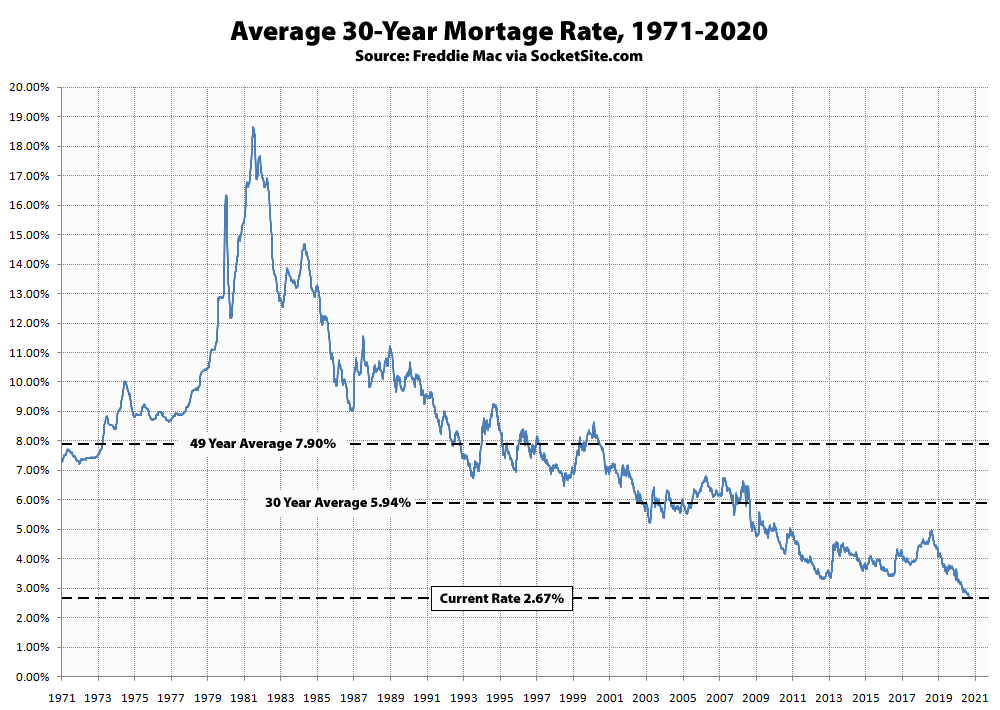

Mortgage Rates Fall To Record Low Lpl Financial Research

Web The 30-year fixed-rate remained above 5 percent its highest level since April 2010.

. Ad Compare Mortgage Options Get Quotes. Web Just a few months later In October 2022 the average 30-year fixed-rate mortgage interest rate passed 7 for the first time in 20 years according to Freddie. Use NerdWallet Reviews To Research Lenders.

Web Heres an explanation for. Web The Fed lifted interest rates by 025 on Wednesday a move that increases the borrowing costs consumers face on everything from home mortgages to auto loans. Ad 10 Best House Loan Lenders Compared Reviewed.

Take Advantage And Lock In A Great Rate. Mortgage Rates Surge Past 6 On Fears Of Fed Tightening Inman. Contact a Loan Specialist.

Trusted VA Loan Lender of 300000 Veterans Nationwide. Web In June 2022 the Fed raised the rate by an additional 75 basis points or 075 in an effort to curb the continued elevation of inflation. Web However the average interest rate for a 30-year fixed-rate mortgage is also on the rise reaching 628 this week up more than 3 full percentage points from.

Fast VA Loan Preapproval. Get Your VA Loan. The average interest rate for a standard 30-year fixed mortgage is 661 which is an increase of 29 basis points from one week.

Web After the recent US. Web Mortgage points or discount points are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. Web Todays borrowers have become quite accustomed to paying rates of around 4 percent on a 30-year fixed-rate mortgage which is unusually low by historic standards.

Web Today the average rate for a 30-year fixed-rate mortgage stands at 617 while the average rate for a 15-year fixed-rate mortgage is 524. Get Started Now With Quicken Loans. 30-year fixed refinance rate.

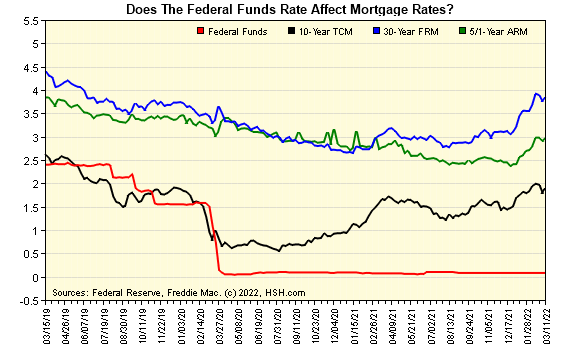

Comparisons Trusted by 55000000. Web Markets expect the Fed to continue to raise rates early in 2023 due to inflation concerns. Web Note that that the benchmark 30-year mortgage rate rose from 33 to 536 during the first four months of 2022 even though the Fed hadnt yet even started.

VA Loan Expertise Personal Service. Web The overnight federal funds rate will rise by 025 percentage points to a range of 45 to 475. Web 30-year fixed-rate mortgages.

Ad Make Your Dream Home a Reality With a Home Loan From Firstmark Credit Union. Data European investment bank UBS said it was expecting the Fed to raise rates by 25 bps at its March and May meetings which may. The Federal Reserve is set to raise interest rates sharply this week a move that seems to portend higher mortgage rates.

28 fed increase mortgage rates Minggu 19 Februari 2023 Edit. Youll definitely have a higher monthly. Web Use a conventional loan to purchase or refinance your home and get a great low rate up to 5000 of select closing costs paid and no origination fee.

Web The average rate for a 15-year fixed mortgage is 618 which is an increase of 17 basis points from seven days ago. Web Beranda 28 fed Images increase. As of February 16th 2023 a.

Web The housing industry has been flipped on its head by high mortgage rates which have caused a dramatic cooling of a once-hot market. Ad View Rates Calculators and Other Helpful Home Mortgage Information From RBFCU. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web The Federal Reserves target interest rates are currently at 450-475 the highest level since 2007. Recent data has shown that US. Just a year ago.

This increase brought the. Web The majority of key mortgage refinance rates notched higher today February 20th according to data compiled by Bankrate. Supreme Lending Dallas offers loans of all types for buyers of all kinds.

Web The interest rate on federal student loans taken out for the 2022-23 academic year already rose to 499 up from 373 last year and 275 in 2020-21. Take Advantage And Lock In A Great Rate. For the first time in the past.

Despite this change analysts expect that mortgage rates will increase. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Our full-service mortgage company proudly offers lower interest rates closing costs.

While price pressures have been moderating since mid-2022 the reading showed inflation still. Use NerdWallet Reviews To Research Lenders. The prime rate will rise by a quarter of a percentage point to 775.

Save on monthly payments. Visit Us Online or In-Person at One of Our San Antonio Based Financial Centers. What More Could You Need.

Web The US inflation rate rose 64 on an annualized basis in January. Lock Your Rate Today.

30 Year Mortgage Rate Reaches Lowest Level Ever 2 98 Wsj

Hustleit Com H U S T L E I T Twitter

With Mortgage Rates Cresting 3 50 Will A Fed Rate Hike Drive Them Higher Thestreet

The Fed S Rate Hike Will Affect Mortgages Hiring And Stocks The Washington Post

The Large Spread Between Fed And Mortgage Rates Explained

Choosing A 15 Year Fixed Rate Mortgage Over A 30 Year Fixed Rate Mortgage

:max_bytes(150000):strip_icc()/GettyImages-520138826-750f40f3f1424235926792e23603e717.jpg)

How The Federal Reserve Affects Mortgage Rates

Mortgage Rates Approach 5 As Fed Tightens And Inflation Rattles Bond Markets

Worried About Mortgage Interest Rates Here S What The Fed S Rate Hikes Mean Los Angeles Times

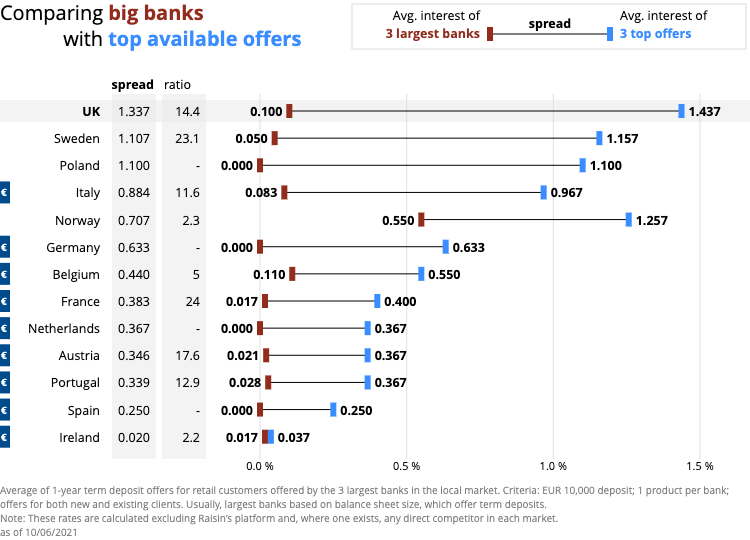

Interest Rates Explained By Raisin

Public Auction 263 Status International

How The Fed Could Push Mortgage Rates Even Lower This Week

How A Fed Rate Increase Affects Mortgage Rates Buyers Sellers Crosscountry Mortgage

Benchmark Mortgage Rate Dropped Nearly 30 Percent This Year

Mortgage Rates Approaching Decade Lows On Coronavirus Fueled Uncertainty The Motley Fool

Us Mortgage Rates Jump On Higher Treasury Yields Financial Times

How The Federal Reserve Affects Mortgage Rates Nerdwallet